Dependent Care Fsa Contribution Limits 2025 Married Filing - Dependent Care Fsa Contribution Limits 2025 Married Filing Irene Leoline, An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year. Dependent Care Fsa Contribution Limits 2025 Married Filing. It remains at $5,000 per household or $2,500 if married, filing separately. For 2023, the maximum amount that can be excluded from an employee's income through a dependent care assistance program is $5,000 ($2,500 if married filing separately).

Dependent Care Fsa Contribution Limits 2025 Married Filing Irene Leoline, An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

Dependent Care Fsa Limit 2025 Over 50 Naoma Loralyn, It remains at $5,000 per household or $2,500 if married, filing separately.

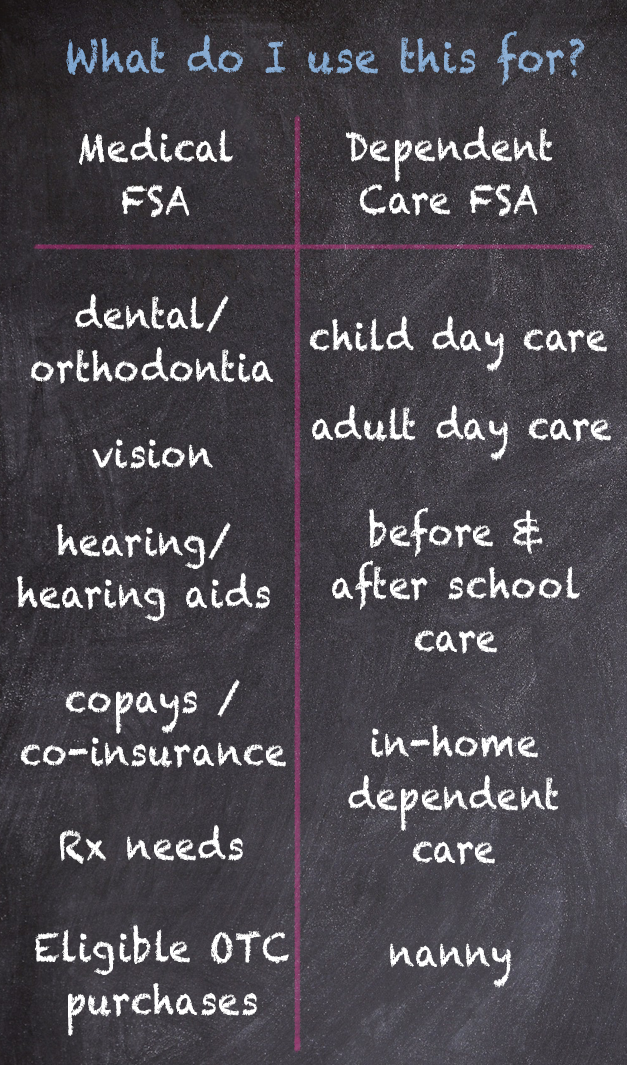

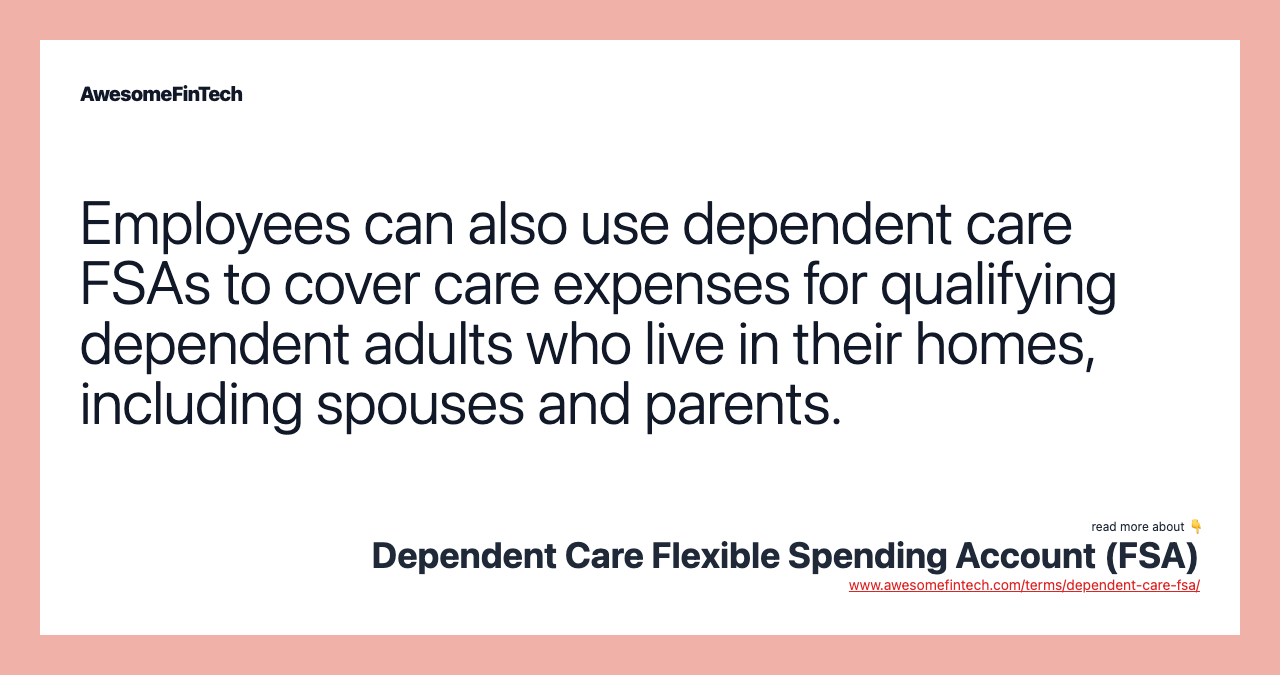

Annual Dependent Care Fsa Limit 2025 Married Ray Leisha, The irs sets dependent care fsa contribution limits for each year.

Dependant Fsa Limits 2025 Tera Abagail, For 2023, the maximum amount that can be excluded from an employee's income through a dependent care assistance program is $5,000 ($2,500 if married filing separately).

Fantasy Football Rankings 2025 Ppr Printable. The nfl unofficially officially kicked off the 2025 campaign […]

Dependent Care Fsa Contribution Limit 2025 Over 55 Row Leonie, What is the 2025 dependent care fsa contribution limit?

2025 X3 M40i Performance. Find & compare performance, practicality, chassis, brakes, top speed,. A community […]

Dependent Care Fsa Contribution Limit 2025 Over 55 Emlyn Iolande, It remains at $5,000 per household or $2,500 if married, filing separately.

Dependent Care Fsa Limit 2025, For 2025, the irs caps employee contributions to $5,000 for single filers and couples filing jointly,.

Dependent Care Fsa Limit 2025 Married Etti Olivie, For 2025 only, as part of the american rescue plan, single filers and married couples filing jointly could contribute up to $10,500 into a dependent care fsa in 2025, and married couples filing separately.

Annual Dependent Care Fsa Limit 2025 Married Filing Lanie Mirelle, It remains at $5,000 per household or $2,500 if married, filing separately.